Navigating Tomorrow: Empowering companies through Futures Thinking for strategic success

Humankind has always wanted to know what will happen in the future. From the rulers of ancient Rome to CEO’s of current companies, all of them have been looking to predict the future, in order to secure their empire or their business. Thankfully, nowadays we have reliable tools to allow us to chart a course through the uncharted waters of the future.

Ancient cultures sought to unravel the mysteries of the future through a diverse array of practices rooted in spirituality, observation, and symbolism. From the casting of lots and interpreting celestial movements in astrology to divining messages in dreams and deciphering the flight of birds in augury, these civilizations blended religious beliefs with practical methodologies to predict the unknown. As those methods didn’t really work as advertised, business leaders and facilitators have turned to Futures Thinking, which provides a structure for thinking how the world could change, and the implications of that for our plans. Futures Thinking can help us to analyse the past and anticipate future trends, and uncover hidden biases and assumptions to enable us to think about the future more creatively.

FUTURES WHAT?

There doesn’t seem to be one universally agreed upon definition of “Futures Thinking”, but in general it’s seen as a strategic and anticipatory approach to understanding and preparing for the future. It involves exploring potential scenarios, trends, and uncertainties to make informed decisions about the future … in the present. It is a multidisciplinary field that draws on insights from various sources, including technology, sociology, economics, and environmental studies, to analyze possible future outcomes. You may have also heard it mentioned under other terms such as foresight, futurism, futurology, anticipation studies, etc.

By examining emerging these patterns, forecasting trends, and considering alternative futures, individuals and organizations can develop more resilient strategies and adapt to changing circumstances. Futures thinking encourages a proactive mindset, fostering the ability to navigate complexities and uncertainties in an ever-evolving VUCA world.

A STEP BY STEP PROCESS

In practice, Futures Thinking sessions will yield a series of scenarios, which are meant to illustrate multiple options for what the future might be without defining an exact prediction. We can then design product concepts for any one of these future scenarios, meaning that the end-point of the Futures Thinking process can be seen as the starting point for a Design Thinking process — one can feed into the other. It is important to realise that Futures Thinking doesn’t tell you what WILL, happen, but what COULD happen.

In a more structured way, a Futures Thinking workshop will try to answer these questions:

- What will occur in my industry in the next 5, 10 or 20 years?

- What are the most important emerging trends and issues?

- What actions, strategies and policies will influence my desirable outcomes?

A Futures Thinking sessions generally takes place in 4 steps:

- Step 1 is “asking the Question”: starting with the right question is key. How far do you want to think (hint, it should be somewhere between 5 and 15 years for real futures thinking)

- Step 2 is “Scanning the World”: what are the drivers that will shape how the question will be answered. In this stage, it is all about gathering the relevant information.

- Step 3 is “Mapping the possibilities”: there is no one future, so in a workshop, we need to find out what the possible outcomes are – is the future better or worse than what you expect?

- Step 4 is “Asking the next question”: how would you answer the original question in each of the futures?

- A 5th step is to start asking follow-up questions. Now, it’s time to address questions such as: What actions and strategies can lead to the best-case or at least an acceptable future? What obstacles are keeping you from taking the necessary steps?What are competitors doing?

(source https://www.synario.com/futures-thinking-and-scenario-planning/)

From this, we will start to formulate strategies and try to lay out a concrete plan. What choices and changes do we need to make to get to an acceptable future? What policies and actions do we need leaders and stakeholders to agree to and adopt? Can this session help us look beyond the probable futures, more broader into possible futures, to identify unforeseen opportunities?

WELCOME TO THE VOROSCOPE

To understand Futures Thinking, it is often explained through the “futures cone“, also known as the “voroscope”, named after its inventor, Joseph Voros (and to confuse you even more, this one is sometimes also called “the cone of uncertainty”)

For more on the origin of the voroscope, please visit https://thevoroscope.com/2017/02/24/the-futures-cone-use-and-history/

The futures cone lists out 7 types of alternate futures, from the default “business as usual” future all the way to “preposterous” scenarios.

One other version of this one is the “Framework Foresight” tool from the University of Houston (https://www.houstonforesight.org/foresight-resources/)

FUTURES THINKING TOOLS

There are a number of specific exercises that are well tailored to Futures Thinking. Below is a non-exhaustive list of tools and exercises that can be used as part of a Futures Thinking session:

Scenario analysis: used in strategic market analysis. Questions to ask here are “what are the most likely scenarios?” and “Can we extrapolate current trends?”

Business model canvas exercises: the BMC can be adapted to imagine different possible futures by altering any of the building blocks in it.

Horizon scanning: the systematic examination of potential threats, opportunities, and likely future developments, including those at the margins of current thinking and beyond conventional foresight timeframes.

TAIDA: Tracking, Analysing, Imagining, Deciding, Acting. Analyse the changes happening around us, imagining a vision, decide on a strategy, and execute that strategy.

The futures triangle (Sohail), with the weight of history, the push of the present and the pull of the future:

Weight of history: What could hold us back? Which barriers are necessary to change? What deep structures are resisting the change?

Push of the present: Which trends push the people towards specific futures? What quantitative trends and drivers are or may be changing the future?

Pull of the future: What is going to pull us towards a specific future? What is a compelling image of the future? Which images in the future are competing?

what if questions: exactly what is says, a guided session to answers “what if” questions to find new ideas and examples for your industry.

The 4 archetypes : Also knows as “Dator’s four futures”, we look at 4 alternative futures: one of continuation, one of (societal) transformation, one of disciplined society, and one of collapse. (for the details, please read https://foresightguide.com/dator-four-futures/)

the Shell approach: associated with the multinational oil and gas company Shell, this is a method in futures thinking and scenario planning that involves systematically exploring possible future scenarios to inform strategic decision-making and manage uncertainty effectively.

Futures wheel : The futures wheel is one of the most widely used methods of futurists. It is a creative way of encouraging people to think about the future. It is usually about organizing a trend or about the ideas surrounding a future development (Bandhold, Lindgren, 2003).

Persona cards: what will the life of persona X look like in 20 years?

trend canvas – collect anc luster trends you see in the world. For an explanation, see https://wrkshp.tools/tools/trend-canvas – you can also find a miro template to a consumer trend canvas on https://www.trendwatching.com/news/ctc-live-on-miro

2×2 SES: 2 by 2 scenario exploration system: find a question (about the future, after all, this is a futures thinking article) you want to investigate, find the 2 most crucial driving forces and work on these in a matrix – here’s an example of to go about it: https://www.futuresplatform.com/blog/2×2-scenario-planning-matrix-guideline

The Sarkar Game: a foresight role-playing game playing the 4 types of power (worker, warrior, intellectual and capitalist). For more information, see https://jfsdigital.org/wp-content/uploads/2013/10/181-A01.pdf and https://library.teachthefuture.org/wp-content/uploads/2017/01/Sarkar-Game.pdf

(some input and ideas came from this paper: https://scriptiebank.be/sites/default/files/thesis/2020-10/Eindrapport-bachelorproef_Facilitating-the-exercise-of-futures-thinking-2019-2020.pdf as well as this strategic foresight presentation: https://coe.gsa.gov/docs/StrategicForesight101.pdf )

SO WHERE SHOULD YOU FOCUS?

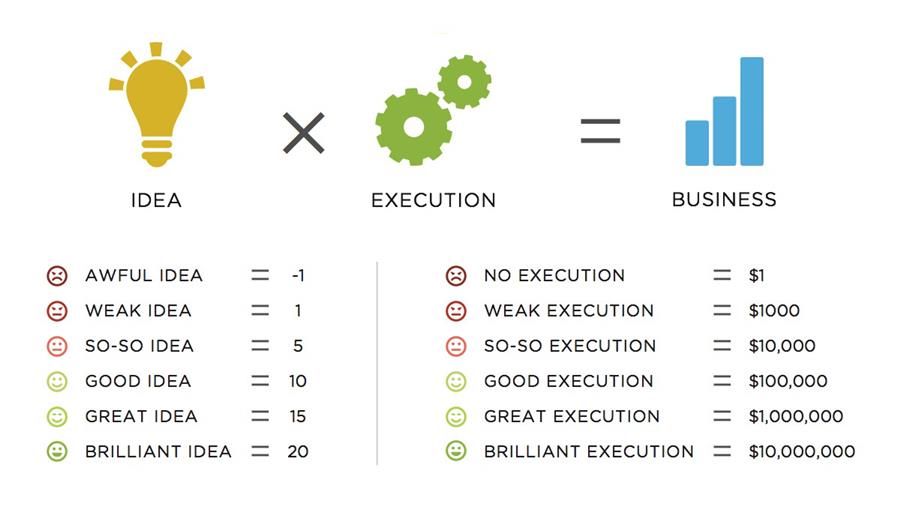

Futures thinking can be useful for when a CEO wants to lead their company into a certain future, without being disrupted by new technology or competitors. What will the company need to do today in order to survive shifts in the market?

For example, if you are running factories, you can analyse the impact of trends like automatisation, on the future of the plants.

Sessions can also be about desirability (what will people want in the future?), Technological feasibility (what could technically be possible in the future), or Economic (how can it become a sustainable business model in the future?).

FURTHER READING

Jane McGonigal, imaginable: https://janemcgonigal.com/2021/12/17/imaginable-how-to-see-the-future-coming-and-feel-ready-for-anything-even-things-that-seem-impossible-today/

Santosh Gandhi on business strategy: https://www.santhoshgandhi.com/post/how-does-futures-thinking-help-for-a-better-business-strategy

Futures and Design thinking explained: https://bootcamp.uxdesign.cc/future-thinking-and-design-thinking-simply-explained-d65716d67651

How Futures thinking is used in EU policymaking: https://knowledge4policy.ec.europa.eu/foresight/tool/scenario-exploration-system-ses_en

A video explanation Top 3 Futures Games: Polak Game, Sarkar Game, and 2×2 Scenario Exploration System: https://www.youtube.com/watch?v=sRt85iHwov8

(PS the main image was generated with ChatGPT – The image has been created to convey what futures thinking is all about, embodying the essence of looking into the future with optimism, curiosity, and strategic planning. It symbolizes the collaborative and multidisciplinary approach to envisioning a range of possible futures.)

Recent Comments