Fractional and interim executive

Strategic Leadership

that scales

with your business

So you’re writing a proposal for an open call…

If you’re a startup eyeing European open calls, here are some invaluable insights from Aneta Gałązka: "Navigating EU Open Calls: A Startup’s Guide to Overcoming Common Challenges" ... and as someone who’s been an evaluator myself, I can wholeheartedly back these...

European Defence Tech Funding Landscape: A Comprehensive Guide for Startups and Scale-ups

I wrote about the involvement of Venture Capital in the defense industry a while back (click here to read up on that one). However, with the current geopolitical tension and Europe looking at investing more in defending itself again, there have been some important...

Navigating Tomorrow: Empowering companies through Futures Thinking for strategic success

Humankind has always wanted to know what will happen in the future. From the rulers of ancient Rome to CEO’s of current companies, all of them have been looking to predict the future, in order to secure their empire or their business. Thankfully, nowadays we have reliable tools to allow us to chart a course through the uncharted waters of the future.

About grey rhino’s, black swans and the incumbent’s dilemma

Image by Holger Detje from Pixabay and by Geran de Klerk on Unsplash There are a number of articles online comparing COVID-19 to a black swan event. But is it really? Let’s check out some definitions. Investopedia describes a black swan as “an...

Startup success is the execution of your ideas

“Ideas are just a multiplier of execution”. To see the true value, you need to multiply the idea with the execution.

If you have a startup, how can you hire your A-team?

One of the things that is important to grow your startup and scale-up is the team composition. Investors tend to look at the team behind the startup, and prefer well-balanced teams. Especially the core team needs to have what we call “complementary skills” – you can’t all be the CEO or the head of tech or the finance wizard.

Venture Capital, the Secret Service and the military

What do spies, soldiers and venture capital have to do with each other, you might ask? Well, even spies need innovative new ways of working and spying. Not to mention that the whole security and protection market is also moving online. Servers and sensitive data need to be protected … or hacked. New wearable technologies need to be developed to support agents and soldiers in the field.

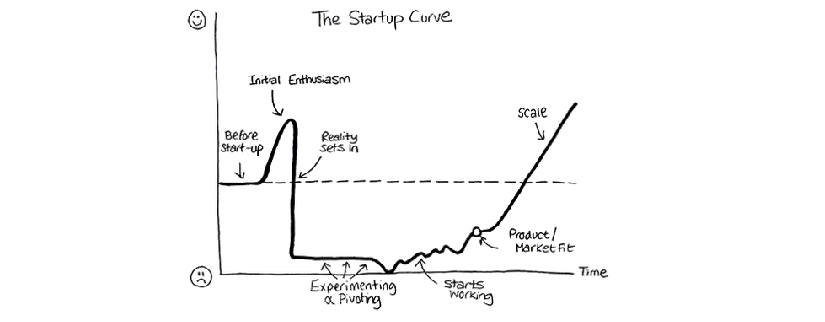

Is there a second valley of death for startups and scale-ups?

Recently, some articles popped up talking about the further challenges for scale-ups, namely in wat is now dubbed “the second valley of death”. What happens to companies once they have secured their first funding rounds and achieved product-market fit?

Always think Attack – what does self-defense have to do with management

Some years ago, I assisted Ignace Van Doorselaere with the creation of his book "Always Think Attack, street fighting techniques for managers". This project allowed me to combine my professional knowledge with my activities as a self-defense instructor. The purpose of...

So you’re looking to fund your startup?

Congratulations, and realise: you are not alone. The startup scene is still growing across Europe and is a focal point of governments, private companies and the EU. On the bright side, this means that there is money available from both private and public sources to...