About grey rhino’s, black swans and the incumbent’s dilemma

Image by Holger Detje from Pixabay and by Geran de Klerk on Unsplash

Image by Holger Detje from Pixabay and by Geran de Klerk on Unsplash

There are a number of articles online comparing COVID-19 to a black swan event. But is it really?

Let’s check out some definitions. Investopedia describes a black swan as “an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences. Black swan events are characterized by their extreme rarity, their severe impact, and the widespread insistence they were obvious in hindsight.”

Impact? Check.

Obvious in hindsight? Check.

Extreme rarity? Not so sure… Humanity’s history has been rife with widespread pandemics. Smallpox, tuberculosis, the black death (killing 75-200 million people in the 14th century), not to mention the 1918 spanish flu pandemic, which killed an estimated 20 to 100 million people (caused by the H1N1 virus which also cause the swine flu pandemic in 2009). SARS, H5N1 (the birdflu), the Zika virus, smallpox (which was virtually eliminated thanks to … vaccinations). And the list goes on As a matter of fact, Bill Gates mentioned it in his Gates notes already in 2015. Which could mean that the new coronavirus wasn’t really a black swan event, but something more akin to a “grey rhino”.

So what is a “grey rhino”? Other than a massive beast that can trample you to pieces, a “grey rhino” is a highly probable, high impact yet neglected threat. Where these differ from a black swan event is that they are NOT random, NOT unexpected, but they are preceded by a number of warnings and visible evidence. Yet, decision makers, governments and companies rarely act on them until it is too late, because they consider them too remote, and neglect them.

“highly probably, high-impact, yet neglected threats.”

So maybe COVID-19 was not a black swan, but something that we knew was coming one day but chose to ignore. Much like big companies tend to ignore incumbents eating away at their margin, while they are focusing on the next quarter’s results of their cash cow products.

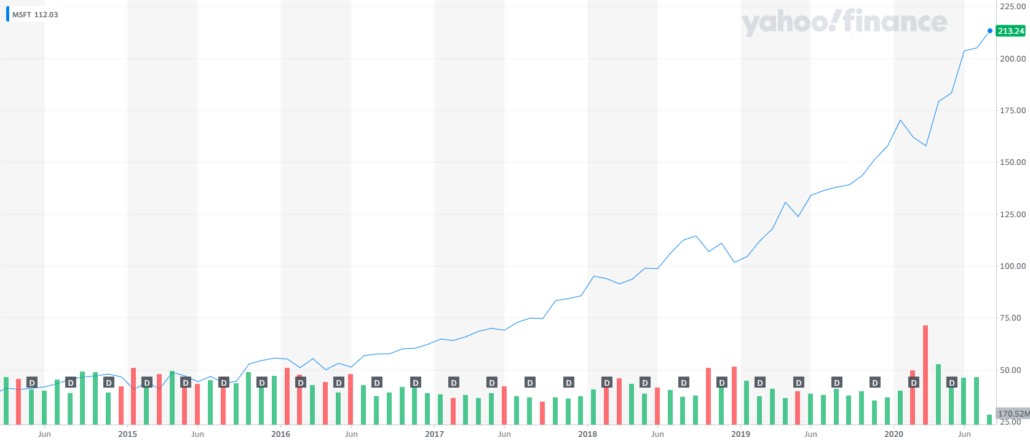

This is something that those familiar with the BCG Matrix (a.k.a. The Boston Consulting Group matrix or growth-share matrix) will recognize. Deciding whether the “question marks” you are investing time, money and effort in will be able to turn into stars or not. This proves to be quite difficult for larger companies, as they are not very keen on betting the firm on new innovations. But for those who do, it can pay off big time. An interesting case study here is Microsoft, that under the leadership of Satya Nadella was able to significantly grow its market cap by making the transition to the cloud and AI (for those interested in more, Nadella’s book “Hit Refresh” is a good read).

The incumbent’s dilemma – why are companies blindsided?

Very often they are blindsided by disruption because they did not see the grey rhino that was coming for them. There is no one reason for this, but it is mostly a combination of the below reasons.

- It can be that their core products are built on “older” tech or legacy platforms that need to be maintained, and where new products or additions need to work/plug in/be backwards compatible with these platforms… Startups, on the other hand, can often start from a clean slate, giving them faster time to market. The answer to this is very simple: accelerated digital transformation (ok, even though the answer is simple, implementing it is a daunting task)

- Due to their structure bigger companies also tend to move slower the bigger they get: testing, retesting, panels, committees, approval loops, all things startups are not bogged down by. This is one of the more difficult things for bigger companies – making sure that innovations from within are not stopped by corporate policies and politics – something that should be recognized by the corporate leadership and addressed from the top through real support for change, and not just innovation theatre.

- And of course the other part of incumbent’s dilemma of keeping their shareholders happy with cash cows generating revenue versus investing in new and unproven products, techniques, business models. Companies should keep an eye out for what is happening in the market, identify the forces that can disrupt their cash cows and make sure to really act on them. Various solutions to address this are possible, ranging from innovation teams over internal programs to stimulate innovation throughout the company, all the way to corporate Venture Capital groups.

As mentioned before, what they absolutely need to avoid is the infamous “Innovation theatre”, where big companies realize that they have the challenges mentioned above, and desperately try to address these with all kinds of innovation initiatives… that then don’t get implemented because of the issues listed above.

In summary, the problems to address are: failure to see the strategic inflection points coming, failure to see the disruptors coming from different angles, and failure to act and really implement change.

PS if you’re wondering what other grey rhino’s are still out there, have a look at this Politico article.

[/av_textblock]

[/av_one_full]

Recent Comments